Freelancing vs Starting a Business: Which Is Right?

Deciding between freelancing and starting a business comes down to your goals, risk tolerance, and work style. Freelancing offers flexibility, quick income, and independence, while starting a business focuses on building scalable systems and long-term growth. Here’s the breakdown:

- Freelancing: You work directly with clients, trading skills for payment. It’s less risky, requires minimal setup, but income is tied to your hours.

- Starting a Business: You create systems that generate revenue, even when you’re not working. It’s more complex, with higher risks and upfront costs, but offers unlimited growth potential.

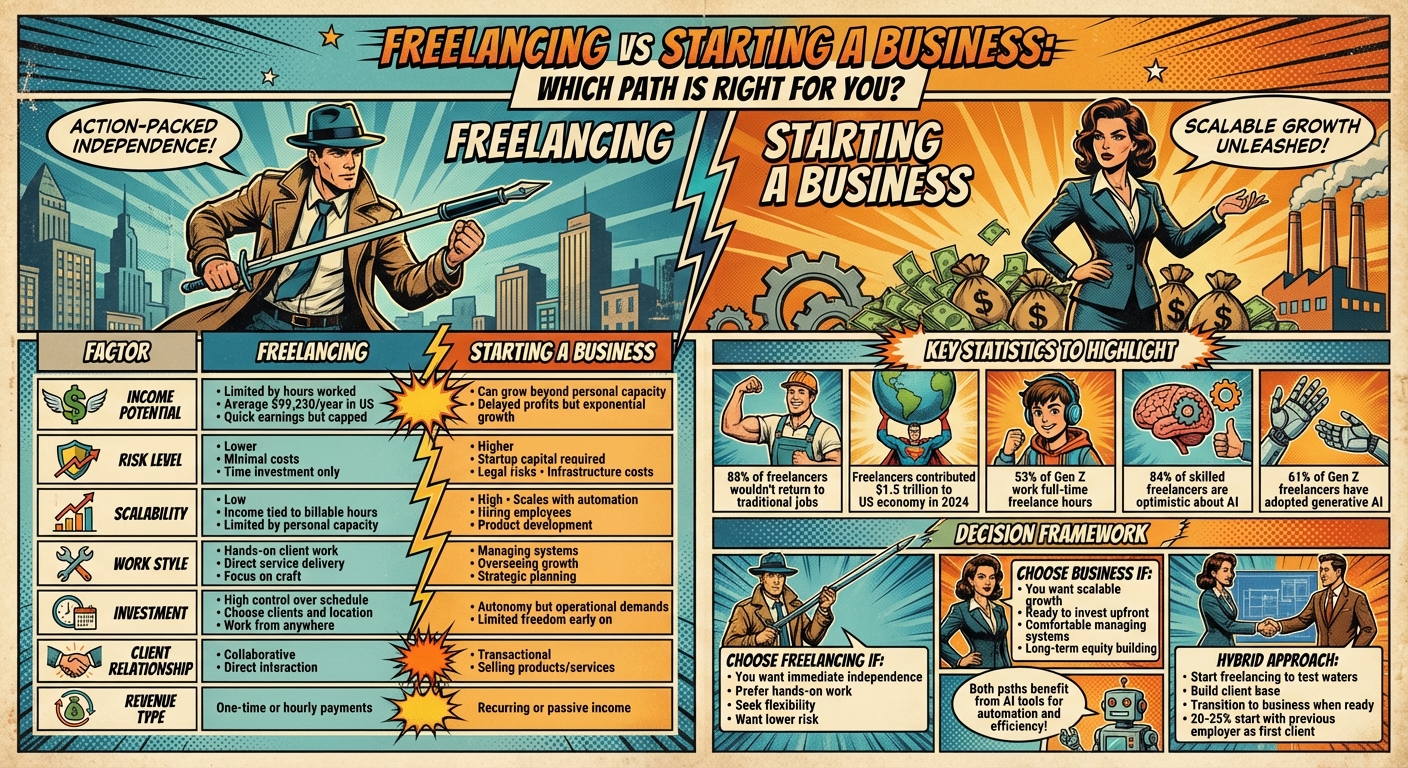

Quick Comparison:

| Factor | Freelancing | Starting a Business |

|---|---|---|

| Income Potential | Limited by hours worked | Can grow beyond personal capacity |

| Risk Level | Lower, minimal costs | Higher, requires upfront investment |

| Scalability | Low | High |

| Work Style | Hands-on with clients | Managing systems and strategy |

| Flexibility | High, control over schedule | Limited early on due to demands |

Key Insight: Freelancing is ideal for those seeking immediate independence and control. Starting a business suits those ready to invest time and resources for scalable growth. Both paths can benefit from AI tools to save time, find clients, and streamline work.

Freelancing vs Starting a Business: Complete Comparison Guide

Freelancing: Benefits and Drawbacks

Freelancing is all about using your skills to earn directly, without the traditional structure of a 9-to-5 job. You pick the projects, set your schedule, and work from wherever you want – often from home. With a simple setup, like operating as a sole proprietor, landing just one client can feel like launching your own business.

The financial potential is impressive. In the U.S., freelancers earn an average of $99,230 annually, contributing $1.5 trillion to the economy in 2024. You control your income – work more hours or target higher-paying clients, and you don’t need anyone’s approval to boost your earnings. Tax deductions for "ordinary and necessary" business expenses, such as home office supplies, equipment, and website upkeep, sweeten the deal. It’s no wonder 88% of freelancers say they wouldn’t go back to traditional jobs. Let’s break down the perks and pitfalls of freelancing.

Benefits of Freelancing

The freedom is undeniable. You choose your projects, set your hours, and decide where to work. Steve King, Partner at Emergent Research, sums it up perfectly:

Ready to leave the job you hate and find the fastest path to online wealth? Learn the best asset you have right now to leverage income and build financial run way in my bestseller "Fire Your Boss." Click here to download the book for free.

"It really boils down to autonomy, control, and flexibility: the autonomy to work in the way they want to, control over what they do, and the flexibility to work when and where they want".

For many, the transition into freelancing is smoother than expected. Around 20% to 25% of independent consultants say their first client was their previous employer. Freelancing is especially popular among Gen Z – 53% of them now work full-time hours on freelance projects instead of traditional jobs.

Drawbacks of Freelancing

But freelancing isn’t all sunshine and rainbows. The biggest issue? Income instability. Freelancers often face unpredictable income cycles, making it tough to budget consistently. Experts recommend saving three to six months’ worth of living expenses before jumping into freelancing full-time.

Another challenge is managing self-employment costs. You’ll need to set aside 25% to 40% of your earnings for taxes, health insurance, and retirement savings – things typically covered by employers. Forget about perks like employer-sponsored benefits, paid vacation, or workers’ comp. Plus, your income is tied to the hours you can personally work, so there’s a limit to how much you can earn.

Then there’s the administrative grind. Freelancers juggle multiple roles, from bookkeeping to marketing. As Vicki James, a business owner, puts it:

"You end up working a lot more than you think, oftentimes way more than when you were working for someone else".

If these challenges sound familiar, AI might be the game-changer you need.

Using AI to Improve Your Freelancing

AI tools are stepping in to tackle some of freelancing’s toughest problems, like income instability and endless admin tasks. A whopping 84% of skilled freelancers are optimistic about how AI can reshape their work and services. Tools like ChatGPT can draft custom client proposals, find new leads, and handle repetitive tasks that used to eat up your day.

Gen Z freelancers are leading the charge – 61% have adopted generative AI, compared to just 41% of full-time employees. AI can streamline invoicing with QuickBooks, manage client relationships using AI-driven CRMs, and keep your marketing consistent with platforms like Mailchimp. This approach, blending human creativity with AI efficiency, allows you to focus on billable work while automation takes care of the rest.

Freelancers are also using AI to maintain a steady flow of clients. AI-powered "Loop Marketing" helps eliminate the feast-or-famine cycle by keeping your lead pipeline full. And if you’re looking to pivot, AI can open doors to high-demand areas like chatbot design or machine learning consulting. In fact, 78% of CEOs believe top freelancers bring more value in these niches than employees with traditional degrees.

Starting a Business: Benefits and Drawbacks

Starting a business shifts your focus from trading hours for dollars to building scalable systems. Instead of constantly chasing the next client, you’re creating something that can generate income even when you’re not actively working. It’s about building equity and long-term value rather than just earning a paycheck.

The potential rewards are huge. As a business owner, you can grow beyond your personal capacity by hiring a team, automating processes, and creating products that sell repeatedly. Paul Jarvis, an entrepreneur and author, sums it up perfectly:

"make your clients so happy & successful that they become your sales force".

Unlike freelancing, where your income is tied to the hours you work, a business allows for exponential growth through systems and leverage.

However, starting a business comes with challenges. You’ll face higher initial costs, longer timelines, and increased administrative demands, from managing IT and HR to dealing with federal reporting requirements like Beneficial Ownership Information filings and self-employment taxes. If you’re operating as a sole proprietor, your personal assets – such as your home and savings – could be at risk if the business fails. And while AI tools like ChatGPT can help streamline some tasks, they can also deliver inaccurate results, requiring careful oversight.

Benefits of Starting a Business

One of the biggest advantages of starting a business is its potential for unlimited growth. You’re no longer limited by the number of hours in a day. By hiring employees and leveraging automation, your income can grow far beyond what a single person could achieve. For example, digital products like online courses, software subscriptions, or other scalable offerings can generate passive income even when you’re focused on other areas.

Another major benefit is building long-term equity. Unlike freelancing, where income stops when you stop working, owning a business means creating an asset that holds value beyond your personal labor. This asset can be sold, expanded, or even passed down. A well-established brand can work like its own sales team, attracting clients and opportunities without constant effort on your part.

Business ownership also gives you greater control. You decide your schedule, your pricing, and even the direction of your company. You have the freedom to pivot your business model as market conditions evolve.

Drawbacks of Starting a Business

The financial risks are significant. Starting a business usually requires more upfront capital than freelancing. If you choose a sole proprietorship or general partnership structure, you’re personally liable for all debts and lawsuits, putting your personal assets at risk. While forming an LLC or corporation offers legal protections, it also comes with added costs and more complex tax obligations.

A strong financial safety net is essential for navigating the early stages. Many new businesses experience revenue gaps, making it critical to have funds available to cover expenses during slow periods. Additionally, running a business means juggling a wide range of responsibilities – from bookkeeping and marketing to legal compliance and customer service – all while delivering your core product or service.

Using AI to Build Your Business

AI is changing the game for startups, helping to reduce some of the risks and costs associated with launching a business. For instance, you can use AI to validate your business idea before making significant investments. Instead of spending thousands of dollars on market research, AI can help you design a validation plan to assess demand, pricing, and potential challenges. As Noah Parsons, CEO of Palo Alto Software, puts it:

"Think of AI as a tool and collaborator, not as a complete solution".

AI also streamlines operations. In 2025, Ross Buhrdorf, CEO of ZenBusiness, introduced an AI assistant called Velo to help small business owners manage taxes, regulations, and banking logistics. Similarly, Kimberly Storin, who runs a custom furniture business in Austin, uses AI to generate quotes, source materials, and create initial designs. This allows her to respond to clients faster while handling other aspects of her business.

Automation is another area where AI is making a huge impact. In 2024, Guillermo Fernandes, a blockchain entrepreneur, reduced his startup’s need for coding interns from four to one by implementing AI-powered coding tools. Carey Bentley, CEO of Lifehack Method, replaced a contractor responsible for email newsletters with AI-generated content, aiming for a threefold return on investment for labor costs. Media consultant Cody Luongo highlights the efficiency boost, saying:

"AI accelerates my work enough that I can do exponentially more for my clients with their allotted budgets".

The trick is to use AI as a starting point while keeping a human touch for quality control. AI can draft business plans, press releases, and marketing materials, but it’s crucial to verify data and refine the output. This hybrid approach lets you move faster and save money while maintaining the professional standards needed to compete in today’s market.

Freelancing vs Starting a Business: Side-by-Side Comparison

Main Differences Between the Two Paths

At its core, the distinction between freelancing and starting a business lies in how you earn and grow. Freelancers trade their time and skills for money, while business owners focus on creating systems that generate revenue. Megan Crist, Founder of Range Creative Studio, puts it this way:

"Freelancers get hired for a skill… Business owners, on the other hand, build systems".

Freelancing can provide immediate income, but starting a business often means putting in months – or even years – of effort before seeing profits. Additionally, freelance earnings are tied to the number of hours worked, whereas a business can scale through automation, employees, or products.

The level of risk also varies. Freelancing is relatively low-risk, as the main investment is your time. Running a business, however, comes with higher stakes – like startup costs, legal responsibilities, managing employees, and the potential for personal financial exposure, especially for sole proprietors. Caleb Porzio, a self-employed developer, highlights this financial challenge:

"A freelancer would have to make $140k (charge $70/hr) to take home the same amount as an employee with a $100k salary".

Another key difference is how work gets done. Freelancers handle tasks directly for clients, while business owners focus on building and managing systems. This shift from "doing" to "building" sets the stage for income growth that isn’t limited by personal capacity.

These differences are summarized in the comparison table below.

Comparison Table

| Factor | Freelancing | Starting a Business |

|---|---|---|

| Income Potential | Quick earnings but capped by billable hours | Delayed profits but can grow exponentially |

| Risk Level | Low to moderate (time investment, minimal costs) | High (startup capital, legal risks, and infrastructure) |

| Scalability | Limited (income tied to hours worked) | High (scales with automation, hiring, and products) |

| Work Style | Hands-on client work | Managing systems and overseeing growth |

| Flexibility | Control over schedule, clients, and location | Autonomy, but operational demands may limit early freedom |

| Investment | Low (basic tools and skills) | Moderate to high (permits, staff, and equipment) |

| Client Relationship | Collaborative (direct client interaction) | Transactional (selling products or services) |

| Revenue Type | One-time or hourly payments | Recurring or passive income from subscriptions/products |

Quiz: Which Path Fits Your Goals?

Not sure whether freelancing or starting a business is the right move for you? This quick self-assessment can help you figure out which path aligns with your skills, goals, and lifestyle. Be honest with yourself as you answer, and keep track of your responses.

1. How do you prefer to spend your workday?

- A. Focusing on the hands-on work I enjoy, like writing, designing, or coding.

- B. Creating systems, managing people, and steering overall strategy.

2. What’s your main motivation for leaving traditional employment?

- A. Gaining autonomy, better work-life balance, and control over my schedule.

- B. Building something bigger than myself with long-term growth potential.

3. How do you feel about financial risk?

- A. I prefer income tied to my skills, even if it’s not entirely stable.

- B. I’m ready to invest time and money now for the chance at bigger rewards later.

4. Where do you see yourself in five years?

- A. Sharpening my craft and maintaining solid client relationships.

- B. Running a business that operates smoothly without needing me day-to-day.

5. How do you feel about managing people?

- A. I’d rather work solo and avoid the complexities of managing a team.

- B. I thrive on leading and orchestrating a group toward a shared goal.

6. What does success look like for you?

- A. Having the freedom to set my hours and choose my clients.

- B. Building a profitable, scalable business that could eventually be sold.

Scoring:

Now, tally up how many A’s and B’s you selected.

- If you picked mostly A’s, freelancing might be the better fit for your hands-on approach and desire for independence.

- If you picked mostly B’s, starting a business aligns with your vision of creating scalable systems and leading a team.

- If your answers are mixed, consider freelancing first to test the waters before diving into a full business model.

As Sara Horowitz, Founder of the Freelancers Union, puts it:

"The most successful freelancers know how to use their network for all sorts of things, like outsourcing work when they have too much".

Freelancing can be a stepping stone toward entrepreneurship, allowing you to gain experience and build a foundation. Interestingly, 88% of freelancers say they wouldn’t go back to a traditional job. On the flip side, entrepreneurs often describe their journey as demanding but deeply fulfilling. The choice comes down to whether you want to work in your business or on it.

Conclusion: Making Your Decision

Deciding between freelancing and starting a business boils down to what aligns best with your goals and priorities. If you’re looking for flexibility, quicker earnings, and the chance to focus on work you enjoy, freelancing could be the better fit. It’s a lower-risk option that lets you dip your toes in the water – start by moonlighting while keeping your day job, test the demand for your skills, and build a safety net of three to six months of savings before going all in. The lifestyle appeals to many, with 88% of freelancers saying they wouldn’t return to traditional full-time jobs.

On the flip side, if your dream is to build something scalable and you’re comfortable with managing people and systems, starting a business might be your path. It requires more upfront effort – setting up legal structures, creating a business plan, and potentially hiring staff – but it offers the chance to grow beyond the limits of your personal time.

Both paths come with unique approaches to managing risk and growth, and today’s tech tools, especially AI, make either option more accessible. For instance, travel advisor Nicole Cueto uses ChatGPT to cut her research time in half, earning about $42 an hour while working just 10 to 20 hours a week. Similarly, 20.5% of professionals who use generative AI weekly report saving four or more hours each week.

You don’t have to lock yourself into one path forever. Many entrepreneurs start as freelancers, refining their skills and building a client base, before transitioning into full business ownership when the time feels right. In fact, 20% to 25% of independent consultants land their first client through a previous employer.

Whether freelancing or starting a business, both offer a way to break free from the traditional 9-to-5 grind, especially with AI tools leveling the playing field. The real question is which option fits your current goals, personality, and timeline.

FAQs

How does income potential differ between freelancing and starting a business?

The earning potential between freelancing and starting a business comes down to factors like stability, scalability, and risk. Freelancing often delivers income faster, but it’s typically limited. Your earnings depend on how many clients or projects you can manage, and since most freelancers charge hourly or per project, there’s a natural ceiling based on your time and capacity.

Running a business, however, opens the door to higher income opportunities by allowing for growth and scalability. Whether it’s hiring a team, expanding operations, or developing multiple revenue streams, business ownership can lead to significant financial gains over time. That said, it usually requires more upfront investment, carries greater risk, and demands patience before profitability kicks in.

Ready to leave the job you hate and find the fastest path to online wealth? Learn the best asset you have right now to leverage income and build financial run way in my bestseller "Fire Your Boss." Click here to download the book for free.

Freelancing is a great option for those who value steady, flexible income with less risk. On the flip side, starting a business appeals to individuals ready to embrace challenges for the chance at greater financial rewards.

How can freelancers use AI tools to handle unpredictable income?

AI tools are a game-changer for freelancers dealing with unpredictable income. By automating those time-consuming, repetitive tasks, these tools free up hours in your day. That means more time to tackle new projects or finish current ones faster, ultimately boosting both productivity and earning potential.

They’re also great for finding clients. AI can analyze market trends and pinpoint your ideal audience, helping you land more consistent work. On top of that, some AI tools come with built-in financial management features, like cash flow predictions or smart pricing suggestions, making it easier to navigate income ups and downs.

Bringing AI into your workflow isn’t just about saving time – it’s about working smarter. It helps you stay efficient, keep your finances on track, and handle those income fluctuations with confidence.

What are the biggest financial risks when starting a business?

Starting a business often means taking on some serious financial risks, with cash flow problems and startup costs topping the list. If you don’t manage your cash flow effectively, you could find yourself unable to cover essential expenses, which could put your entire business at risk. On top of that, initial costs like developing a product, stocking inventory, launching marketing campaigns, and handling legal paperwork can pile up fast, creating extra pressure on your finances if you’re not prepared.

There’s also the possibility of losing the money you’ve invested – whether it’s your savings, borrowed funds, or contributions from investors. If your business doesn’t perform as planned, this could also mean sacrificing income stability, especially if you’ve left a steady job to chase your entrepreneurial dream.

To minimize these risks, you need a solid financial plan. This means mapping out realistic income goals, forecasting your cash flow, and crafting a smart funding strategy. By planning ahead, you can make sure you’re equipped to handle obstacles and hit those critical milestones.

Related Blog Posts

Ready to leave the job you hate and find the fastest path to online wealth? Learn the best asset you have right now to leverage income and build financial run way in my bestseller "Fire Your Boss." Click here to download the book for free.